Are you trying to figure out how to create a Pay schedule for your company? Running a company is difficult enough, so we have the answer for you.

Having a comprehensive payroll system that is fully automated is important for any company. However, many business owners don’t think about creating a pay schedule.

Put together a company payroll schedule that will benefit your employees and yourself. The benefits of a payment schedule will help offer consistency, predictability, and fairness to your employees and yourself.

Schedule your payroll based on what you deem important for your employees, such as sales goals or commissions, for example.

To help you along the way, we created this simple guide to creating a payment and payroll schedule for your employees.

Define Your Companys Pay Schedule Structure

Assuming you own a small business with hourly employees, you will need to create a payment schedule to ensure your staff is being paid on time. Depending on the state in which your business is located, pay periods must be set up so that employees are compensated at least once a week, biweekly, or semi-monthly.

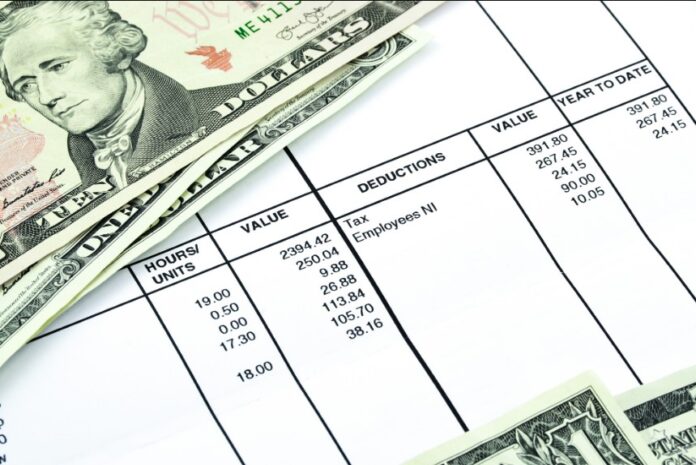

You will also need to track the number of hours each employee works per shift. To determine pay periods, you must first calculate the total number of hours worked in a week. This can be done by totaling the number of hours worked per day and then multiplying that number by the number of days worked in a week.

The number of hours worked in a week will generally fall into one of three categories: full-time (40 hours), part-time (less than 40 hours), or overtime (more than 40 hours).

Once you have determined the number of hours worked in a week, you can then set up your pay periods accordingly. This schedule should be posted in a prominent place so that all employees are aware of when they will receive payment.

Consider Taxes and Withholdings

Once you have determined the gross pay, you can then withhold the appropriate taxes and other deductions. Common deductions include income taxes, Social Security, and Medicare.

You will also need to withhold any garnishments or child support payments. After the deductions, you will be left with the “net pay,” which is the amount that the employee will actually receive.

Hire a Professional

If you are looking to create a payment schedule for your company, hiring a professional may be the best route to take. Hiring a professional like www.payrollserviceaustralia.com.au to help ensure that your company is in compliance with all state and federal laws.

They will also be able to help you develop a system that is fair and equitable for all employees.

Create a Beneficial Pay Schedule

By following the steps outlined in this article, you can create a Pay schedule that works for your company. Keep in mind the needs of your employees and your business when creating the schedule, and be sure to communicate the schedule to your employees ahead of time.

With a little planning, you can create a Pay schedule that benefits both your company and your employees.

If you find this article helpful, check out more of our blogs!